Request study in PDF format

Purpose and framework

Several uncertainties usually come with long-term decisions such as warehouse automation projects. In our interactive model, you can change these parameters to understand the interplay between them and evaluate whether an investment would make sense for you. For more context, we invite you to download our study on the topic.

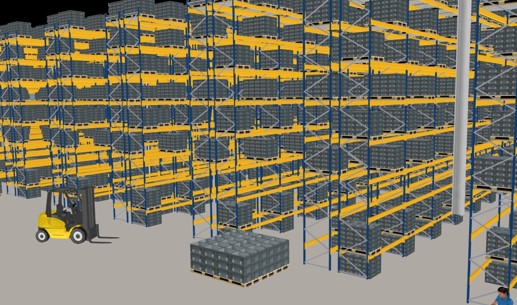

Numerous technological varieties and functionalities are currently available. Based on a case study with real-world data, we compare a manual forklift solution with stacker cranes and an automated solution with automated guided vehicles for storage, retrieval and transport. The objective is to compare the financial key performance indicator (KPI) of a payback period for both options. The payback period indicates how long it would take to reimburse the initial investment through lower operational costs.

The interactive framework allows you to assess the influence of certain factors on the payback period of an automated warehouse. The model is based on optimally designed layouts of manual and automated warehouses, which were derived from a case study based on real-world data and a service level requirement assumption of 98.5% (γ service level).

- Process in scope: storage, retrieval and internal transport

- Technologies: forklifts (manual) and a combination of stacker cranes and automated guided vehicles (automated)

- Target service level: 98.5%

- Handling units: pallets

- Average pallet movements per day: 4,900

- Daily throughput capacity: 6,600 pallet movements

- Number of pallet storage locations: 17,000

- Labor cost: €20.5 per hour

- Investment cost: €3 million (manual) and €9 million (automated)

- Warehouse rent: €60 per square meter (manual) and €100 per square meter (automated)

Labor cost and rent influence the profitability

The higher the labor costs, the more competitive the automated warehouses are compared to manual, labor-intensive warehouses. Together with warehouse rent, these location-specific cost drivers are operational costs.Investment cost and performance parameters

Automation comes with a high initial investment in technology. Streamlining the warehouse’s performance is critical for cost considerations – in this context, dual command enables put-away and retrieval to be carried out in a single process step. The higher the amount of dual commands, the higher the operation's efficiency.Summary of your configuration

Findings

Demand volatility should not be underestimated in warehouse planning. Extensively analyzing the decision of whether to automate a warehouse reveals the interdependencies between all of the other relevant influence factors. Please keep in mind that the parameter setting is only valid in the model framework. However, it allows conclusions to be drawn for your next warehouse planning project.Does this topic interest you? Contact us to explore your individual warehouse planning challenges together. We look forward to hearing from you.

4flow research

We look forward to hearing from you.

The team behind the study

Researcher

4flow research

Researcher

4flow research

Head of 4flow research

4flow research

Manager

4flow consulting

Principal

4flow consulting

Partner

4flow consulting